The Somali government’s new tax on all electronic sales transactions has sparked widespread concern and discussion among both the public and officials. This tax, initially introduced in 1984 but never enforced due to technical issues, is now fully operational thanks to recent advancements.

Finance Minister Bihi Iman Egeh explained that the government has implemented a modern system to efficiently monitor, track, and assess these taxes. The tax rate is set at 5%, which Egeh claims is lower than in many neighboring countries, in order to encourage tax compliance among the population. The government has directed telecommunications companies and other digital service providers to work with tax officials to make collection easier..

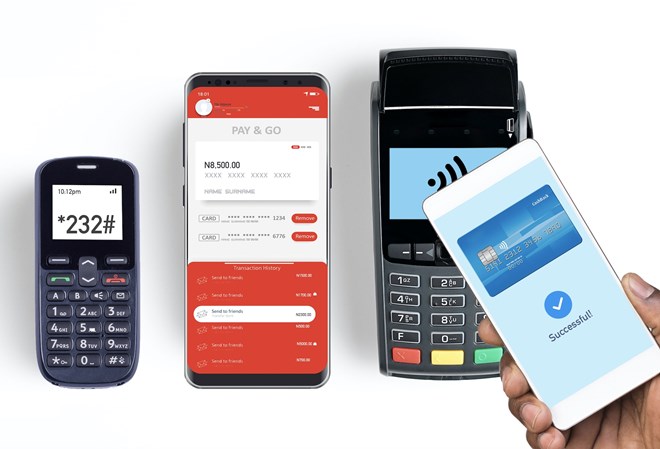

The new taxation system affects transactions conducted via mobile money transfers, e-wallets, and other electronic payments for both the general public and businesses.

Abdifitah Dahir Harun, an economics professor at Horseed University in Mogadishu, commented on this tax’s potential benefits and drawbacks.

“The government can use the new revenue to invest in economic infrastructure, increasing overall income and reducing dependency on foreign aid,” Harun explained. However, he also acknowledged the potential negative impact on the public.

“People’s expenses will increase as the tax applies to their final transaction amounts, which might lead to a decrease in the use of these electronic services,” he added.

Business analysts worry that the shift could result in a return to cash transactions, reversing the recent growth in digital payments.

The tax’s introduction has led to confusion and criticism. MP Dahir Amin Jeesow raised concerns in parliament about the tax’s specifics, questioning how it applies to non-commodity transactions like education and healthcare. He asked, “If I send one dollar to someone, will I be taxed for that? Will it be classified as a purchase? What does this tax mean in practical terms?”

There is also uncertainty about how the tax will apply to non-commodity transactions, such as education and healthcare. “Are we taxing digital payments at hospitals and schools?” Jeesow continued.